If you listened to the podcast version, you’d note I added some music. I broke out my skills in Garageband to make a quick accompanying jingle to spice up the podcast. Let me know what you think. 🎵

On to this week’s topics.

I’m astonished I didn’t get roasted for completely dissing Blockchain as a useless technology a couple of weeks ago. I thought I’d talk about an example where I’m actually quite bullish about the technology. But first I wanted to expand upon a thought I had following a conversation I’d had with someone, discussing why digital commerce is so different from brick and mortar commerce. Follow on for my thoughts.

The unique challenges of digital commerce for physical goods

The difficulty for online retailers selling physical goods in the digital economy is that the value of digital products is significantly reduced, and in some cases, is virtually zero. That inherently puts pressure on the value of physical goods that are commoditised. Fortunately, luxury goods are seeing less pressure on their perceived value, but that is more a function of time rather than real value.

Luxury goods houses and retailers are seeing these changes and are starting to act. Apple today has changed its retail sales processes to resemble more of a luxury brand one-to-one service rather than a Walmart get-it-off-the-shelf-yourself operation.

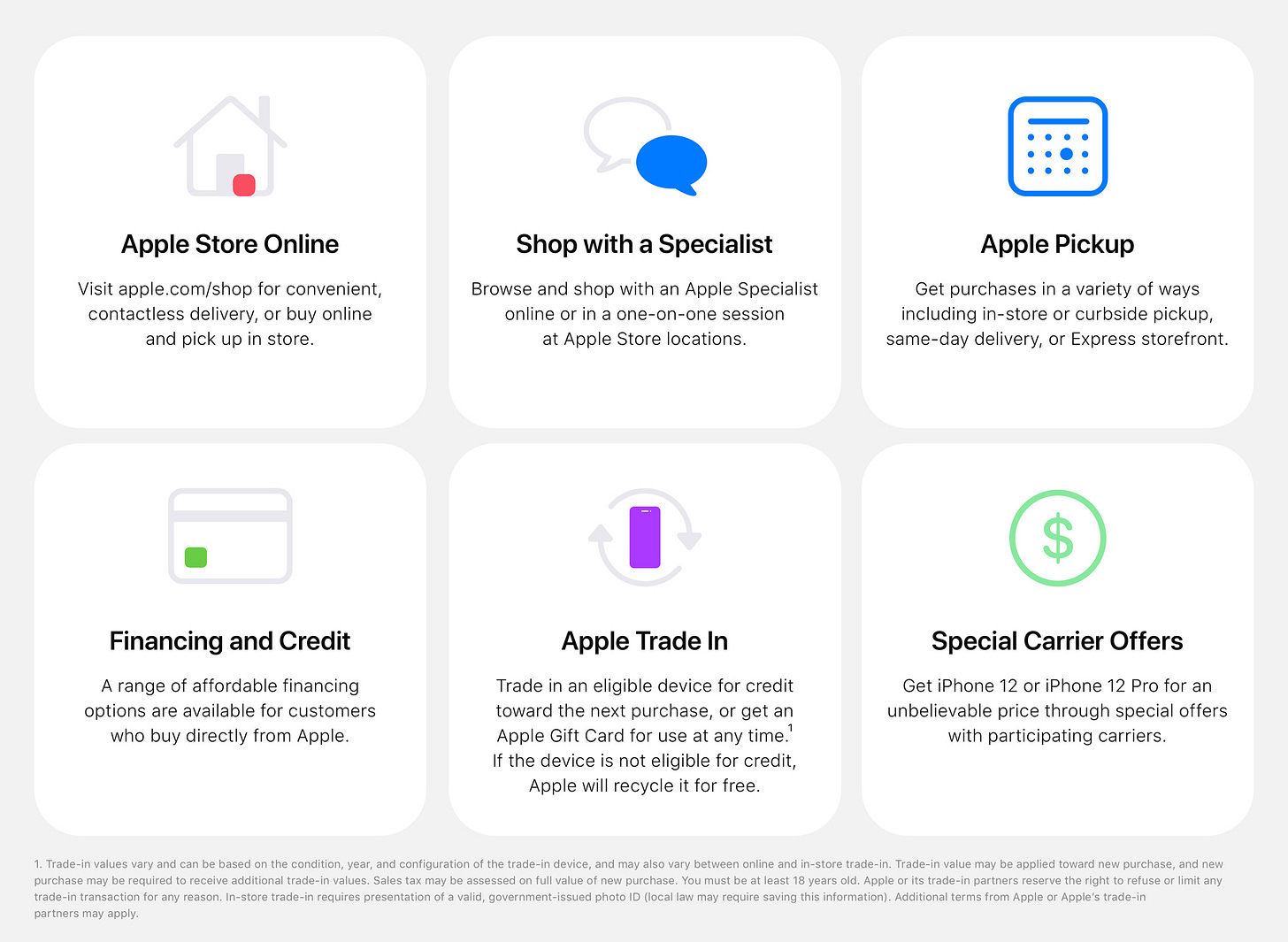

From Apple’s press release:

When iPhone 12, iPhone 12 Pro, and iPad Air are available Friday, October 23, customers can get their all-new products directly from Apple through tailored purchase experiences offered online, by phone, or in store. From a chat session with a Specialist that starts online and finishes with contactless delivery, to visiting select Apple Store locations for a one-on-one session with an Apple Specialist, customers can find the best way to get the products they’re looking for.

Source: Apple

So, the question is, how do businesses make money now that the products they sell are virtually worthless (economically speaking)?

Answers to some of that lie in the services surrounding the product. Be that sales (see above), installation/delivery, support, subscription, ongoing help and many other possibilities, the key lies in giving the customer an ‘experience’ rather than a sale. Deriving value comes from developing and innovating on several levels to create a whole greater than the sum of its parts.

If we look at the above example from Apple, you’ll note they’re selling a phone. But that phone is so much more than a simple “… Widescreen iPod with touch controls, a revolutionary mobile phone and a breakthrough internet communicator.”. The iPhone has replaced by some estimates, over 50 products; mobile phone, point and shoot camera, a torch, calendar, SatNav, personal assistant, to name a few. But it is a product in a sea of other products that are designed to resemble each other closely. There is little material difference between the flagship Samsung and Google devices that are directly competing with the iPhone. And, Smartphones themselves are becoming commoditised, as is evidenced by the increasingly smaller and smaller gains made in hardware design and technologies deployed. The differentiator is the software and what that software can enable hardware to do for the overall end-user experience.

Two excellent examples are computational photography and health analytics.

In computational photography, we are nearing the phase whereby even specialist cameras of the past are being innovated out of existence. It is only a matter of time before the computational aspect will outperform pure optical limitations of smartphone camera modules. In health, simple movement sensors initially enabled step tracking, instantly killing a growing market segment, and eventually enabled detailed sleep tracking that has (itself) been out-innovated by smartwatches. It is no longer science fiction to imagine the doctor’s office on your wrist.

The overall experience of owning these products and their potential beyond the initial use-case is what I mean when I say ‘customer experience’. Apple has gone that step further and developed and Covid-friendly white-glove shopping experience previously reserved for the rich and famous. You book a 1 to 1 either in-store or directly on the Apple Retail site, and you are led through your purchase to contactless delivery or pick-up. It is a personal shopping service for the rest of us.

Who doesn’t want to be made to feel special when buying something?

Blockchain. Again

I’m surprised I didn’t get more of a roasting from my somewhat sceptical articles about Blockchain here and here:

According to a detailed academic-style “peer-reviewed” study by the Centre for Evidence-Based Blockchain and reported in the FT:

“… outside of cryptoland, where blockchain does actually have a purpose insofar as it allows people to pay each other in strings of 1s and 0s without an intermediary, we have never seen any evidence that it actually does anything, or makes anything better. Often, it seems to make things a whole lot worse.”

Worse, the report repeatedly highlights that the technology is a solution currently looking for a problem. The antithesis to the Jobs to be Done theory that helps us better design and provide solutions. With over 55% of projects showing no evidence of useful outcomes, over 45% showing “unfiltered evidence” (i.e., next to worthless), it would appear that Blockchain is a belief-system rather than a technological solution.

And …

…it is a huge energy consumer and hence by definition is inefficient. That, sadly, is not its only efficiency problem. Blockchain is actually extremely limited in its speed and quantity of transactions and scales poorly. So much so that in 2016 several banks exploring the possibility of using the technology in the personal and business banking sector abandoned the work as blockchain was just too slow.

Quite the downer if I’m honest. But whilst many projects show no use for Blockchain, some projects show promise. One such example is Dominica’s Economic Growth team at the Climate Resilience Execution Agency for Dominica (CREAD).

They are currently developing a parametric insurance product that uses blockchain technology to help small businesses and the typically underserved by traditional insurance products, manage their risk of natural disasters in an innovative way. It’s called BHP or Blockchain Hurricane Protection. From the article on LinkedIn:

BHP aims to extend coverage to those excluded from traditional indemnity insurance, and provide Dominicans with a flexible and affordable tool for managing climate risk. Total damage from Hurricane Maria which struck the island as a category 5 storm on September 18, 2017 was US$1.3 billion, representing 226% of GDP. Uninsured losses were US$1.1 billion, or 86% of total damages. Damages to the housing sector totalled US$520 million. MSMEs suffered US$73 million in damages, and agriculture also suffered US$73 million in damage. In the years since Hurricane Maria, premiums for traditional indemnity policies have increased by more than 80%.

This was the background to Dominica’s drive for innovation to better protect itself after multiple incidents that substantially affected citizens and businesses over the last decade.

So, what is a Parametric Insurance and why blockchain?

From Wikipedia:

Parametric insurance is a type of insurance that does not indemnify the pure loss, but ex ante agrees to make a payment upon the occurrence of a triggering event. The triggering event is often a catastrophic natural event which may ordinarily precipitate a loss or a series of losses. But parametric insurance principles are also applied to agricultural crop insurance and other normal risks not of the nature of disaster, if the outcome of the risk is correlated to a parameter or an index of parameters.

What’s great about this project is that it is intelligently using technology in the right places to fulfil the “Job to be Done”. Again, from that LinkedIn article:

Once customers have downloaded the mobile wallet to their smartphone, they simply indicate the level of coverage that they would like to purchase, tag the location where they want the policy to apply, enter some basic information, and pay the premium. The policy is then issued and stored in the blockchain. In the event of a triggering event that meets the criteria of the policy, the payout is generated automatically and delivered to the customer's mobile wallet within three days of the triggering event.

This product reduces friction at the critical stages of an insurance lifecycle; the signup and the payout.

You’d be right in asking why a “normal” insurance product couldn’t do the same. And there’s no reason traditional insurance can’t reduce friction when it comes to the signup and management of the product. Payout is where the difficulty lies. Frequently, insurance companies need to wait for a “Natural Disaster” to be declared or during a smaller indecent, assessors and inspectors to audit and report back to the insurer before the insurer can start the payout process, which itself can be lengthy and time-consuming.

In this product, they are disrupting traditional insurance at a particular level — this is not general insurance — and that disruption, like all disruptions, is to the benefit of customers in the way of simplification and increased speed in onboarding and payouts. Not to mention the pricing that makes it more accessible and hence more likely to be adopted, benefitting all in the process.

But the interesting aspect from a tech point of view is the use of blockchain. In this instance, it is playing to blockchain’s strengths and not trying to overcome its weaknesses (see above). And that’s the intelligent way to use it.

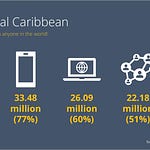

BHP is a product that doesn’t need to scale to hundreds if not thousands of transactions per millisecond like traditional banking systems deployed around the world. For one, Dominica (thankfully) doesn’t suffer a significant natural disaster every day, and secondly, its population is currently only around 73 000 people. Today’s blockchains are more than capable of sustaining the likely transaction requirements of this implementation. And suppose BHP is available to a broader audience throughout the Caribbean, it is still unlikely to overwhelm the system, as processor designs and energy efficiency gains are around the corner.

A cursory glance shows that the major chip designers and builders are all exploring the possibilities of tailoring their products for blockchain applications to overcome the shortcomings of the technology.

https://www.amd.com/en/technologies/blockchain

https://www.intel.com/content/www/us/en/security/blockchain-overview.html

Interesting times.

You can find the archives of all my essays here:

The Future is Digital Newsletter is intended to inform and entertain on the topic of tech and the digital world. Share it to someone you know who would like it.

If this email was forwarded to you, I’d love to see you on board, here’s where you can sign up spam-free:

Thanks for being a supporter, have a great day.

Digital Commerce. Blockchain (again)